Gretchen Hayden is a writer creating insightful content across the healthcare revenue cycle. She produces content for Zelis and previously for Sapphire Digital, a leading member navigation and shopping platform. With a deep interest in healthcare finance, Gretchen helps Zelis clients stay current on trends in the healthcare payments market, with an engaging and provocative perspective.

Inflation has cooled a bit, but the heat of high prices is forcing difficult trade-offs.

Weighing options

Inflation may have recently cooled from its 40-year high, but employees are still feeling the heat of elevated pricing—and they are reevaluating where to spend their hard-earned dollars.

According to a recent poll, Americans are making concessions regarding healthcare due to the effects of inflation. Ever-increasing prices of gas, food, and electricity have forced many families to make difficult trade-offs.

The poll, from WestHealth and Gallup, found that over a third of households in most income brackets—including 20% of households that make $180K or more—have “delayed or avoided medical care or purchasing of prescriptions” due to rising costs.

Inflation is expected to stay at its current level into 2023, placing continued pressure on families debating the costs of their every day expenses.

Healthcare the least affected

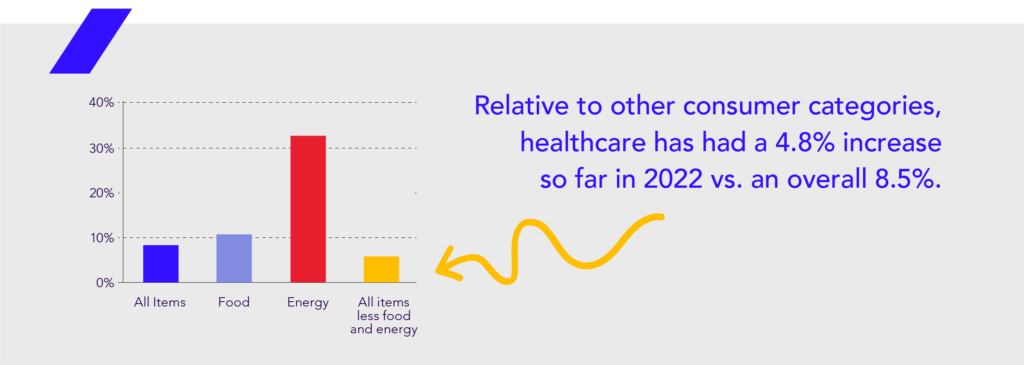

Ironically, the thing that many families are putting to the back-burner has seen the least increase in pricing. Relative to other consumer categories, healthcare has had a 4.8% increase so far in 2022 vs. an overall 8.5%.

Consumers who are putting healthcare on hold may assume healthcare pricing is just as inflated as their electric bill. Providing education around current costs of care as well as around the price discrepancies between providers or facilities could help alleviate the stress of seeking care when wallets are tight.

Easing inflation woes

Other ways to encourage employees to seek care during challenging financial periods is to ensure they know how to keep other costs low.

Financial experts make it clear: the best ways to beat inflation are by prioritizing expenses, lowering bills and diversifying/increasing income. This means placing dollars where they are essential first—food, housing and medical care.

Next, consumers should educate themselves on what they are paying and negotiate better rates for services they can’t do without.

Another simple way to level the pricing playing field is to take full advantage of cash-back and rewards programs that can help offset costs of necessities.

Built-in inflation buster

Marrying the inflation-busting methods of price comparison and rewards programs is a Zelis solution called SmartShopper®.

SmartShopper® is a guided shopping platform that empowers employees to make better healthcare choices, get rewarded and share in the savings. The platform can integrate with the health plan portal and provides employees with resources to compare costs and make informed decisions. When they use an eligible provider, they receive dollars back; the average being a $92 reward.

In the words of a current client, SmartShopper® is “just easy.” Implementation of the platform and the program is simple to activate, and includes concierge support and a digital engagement strategy to take the burden of onboarding off benefits administrators.

By shopping for healthcare, employees can feel empowered seeing price transparency for procedures and providers. SmartShopper® takes away the mystery of cost during a time when so many may avoid care due to budget constraints. And getting rewarded means there is motivation to stay on top of preventative care—while receiving inflation-busting cash back in their pockets.

To learn more, lead the 2022 SmartShopper Performance & Savings Report, or contact us at [emailprotected] to find out how to activate SmartShopper.