By Amanda Eisel

Amanda Eisel has focused the last 20 years of her career at the intersection of healthcare and technology. She has been deeply involved creating and scaling multiple growth technology companies including Waystar, Applied Systems and Viewpoint. Amanda has been a member of the Zelis team since 2019, playing a leadership role across Zelis’ growth, operational and talent strategies. Amanda started her career at McKinsey & Company, where she spent nearly a decade advising consumer companies. Prior to Zelis, Amanda was an Operating Partner at Bain Capital focused on technology and healthcare IT companies.

There’s an old, spooky illustrated tale called The Doubtful Guest, about a mysterious penguin that appears in a family’s home and stays for 17 years with “no intention of going away.”

While it hasn’t been 17 years, inflation is the strange beast that just won’t see itself out. As much as we like to stop hearing about it (and of course, see smaller numbers on our bills and receipts), the “Tales from the Gas Pump” don’t seem to be going away any time soon.

Inflation may have cooled recently from its 40-year high, but we’re all still feeling the heat of elevated pricing—and re-evaluating where to spend our hard-earned dollars, and healthcare is not excepted from this scrutiny.

Reprioritizing necessities

A recent poll from WestHealth and Gallup, showing that Americans are making concessions regarding healthcare due to the effects of inflation. The poll found that over a third of households in most income brackets-–including 20% of households that make $180K or more—have “delayed or avoided medical care or purchasing of prescriptions” due to rising costs of everyday purchases. This is concerning and heartbreaking. I can’t help but wonder how many families in need of healthcare are making these difficult trade-offs so they can afford gas, food, and electricity instead. People shouldn’t have to de-prioritize healthcare.

Healthcare is slow to change—for now

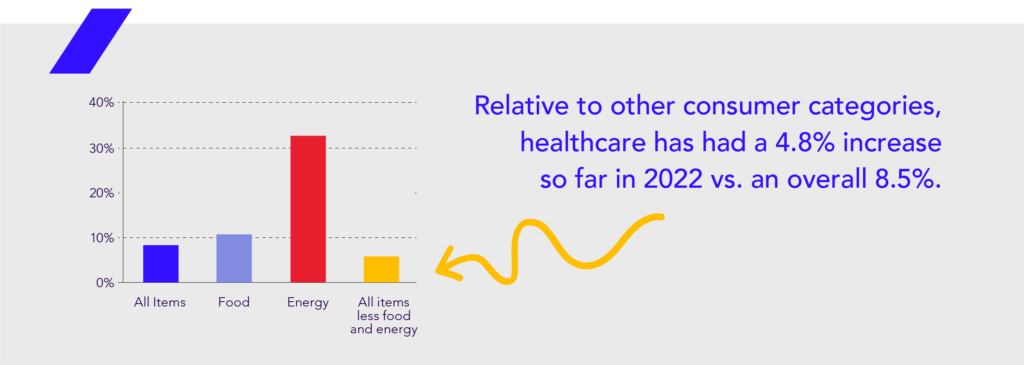

Understandably, consumers who put healthcare on hold may assume healthcare pricing is just as inflated as their electric bill. Ironically, the thing that many families are putting to the back-burner has seen the least increase in pricing. It’s generally understood that healthcare is less-affected by economic swings—and the current numbers don’t lie. Relative to other consumer categories, healthcare has had a 4.8% increase so far in 2022—which has been slow-building—versus an overall 8.5%.

The unfortunate reality is that we’re in a suspended state regarding healthcare cost increases. Given COVID-19 subsidies, relatively long contracting periods, and notable labor shortages, I and other leaders in healthcare get a very strong sense that cost increases will mirror what other industries are facing; we just haven’t gotten there yet.

In times like these, when financial stress will continue to churn the stomachs and bank accounts of hardworking families, support is essential.

Easing inflation worry

Fortunately, there are tools and resources consumers can use to better understand healthcare costs, and subsequently make decisions to ease financial woes. We, as healthcare industry leaders, can educate consumers about how to access information around the current costs of care as well as the price discrepancies between providers or facilities. We should remind members about the programs in place to empower their healthcare decision-making (and if you don’t have a program in place, give us a call). Better understanding of costs can help alleviate the stress of seeking necessary care when wallets are tight.

Other ways to encourage families to seek care during challenging financial periods is to provide ideas about how to keep overall costs low. Financial experts make it clear: the best ways to beat inflation are by prioritizing expenses, lowering bills and diversifying/increasing income. This means placing dollars where they are essential first—food, housing and medical care.

Consumers can also educate themselves on what they are paying and negotiate better rates for musts like cell phone and internet services. Another easy way to level the pricing playing field is to take full advantage of cash-back and rewards programs that can help offset costs of necessities. Think: credit card rewards, grocery store incentives, and—can you blame me?—benefit rewards programs through health plans or employers. Some of the simplest ways to get money back in your pocket is to take advantage of programs that reward for actions you are already taking.

In addition to individual efforts, I’d be remiss from a historical perspective if I didn’t bring attention to the Inflation Reduction Act (which passed last week). The Act included measures to control out-of-pocket prescription drug spending for Medicare recipients. Medicare will be able to negotiate prices for drugs for the first time ever, hopefully lowering costs for our seniors. For those covered under the ACA, insurance subsidies have been lowered.

Inflation is expected to continue to creep in the shadows into 2023. We can support our employees and members by providing the right tools and information for their healthcare journeys and communicating support and recognition that inflation is a large factor looming over their everyday decisions. Never doubt that in tough times, Zelis is on your side.