Court decides QPA calculations in NSA TMA III decision

In early November, the US Court of Appeals for the Fifth Circuit issued a ruling on the government’s appeal of a No Surprises Act (NSA) lawsuit brought by the Texas Medical Association which, among other things, addressed how health plans must calculate their Qualifying Payment Amounts (QPAs).

There has been a string of lawsuits over the legitimacy of the NSA and its implementing regulations, though industry has been mostly focused on four suits brought against the federal government by the Texas Medical Association, or TMA, in a district court in Texas.

The TMA racked up a series of wins in these cases, prompting major changes in the law’s implementation. Subsequently, in two cases, the government appealed the rulings, one of which, the second lawsuit or TMA II, the government has already lost. That left one final appeal – on TMA III – to be decided before closing the loop.

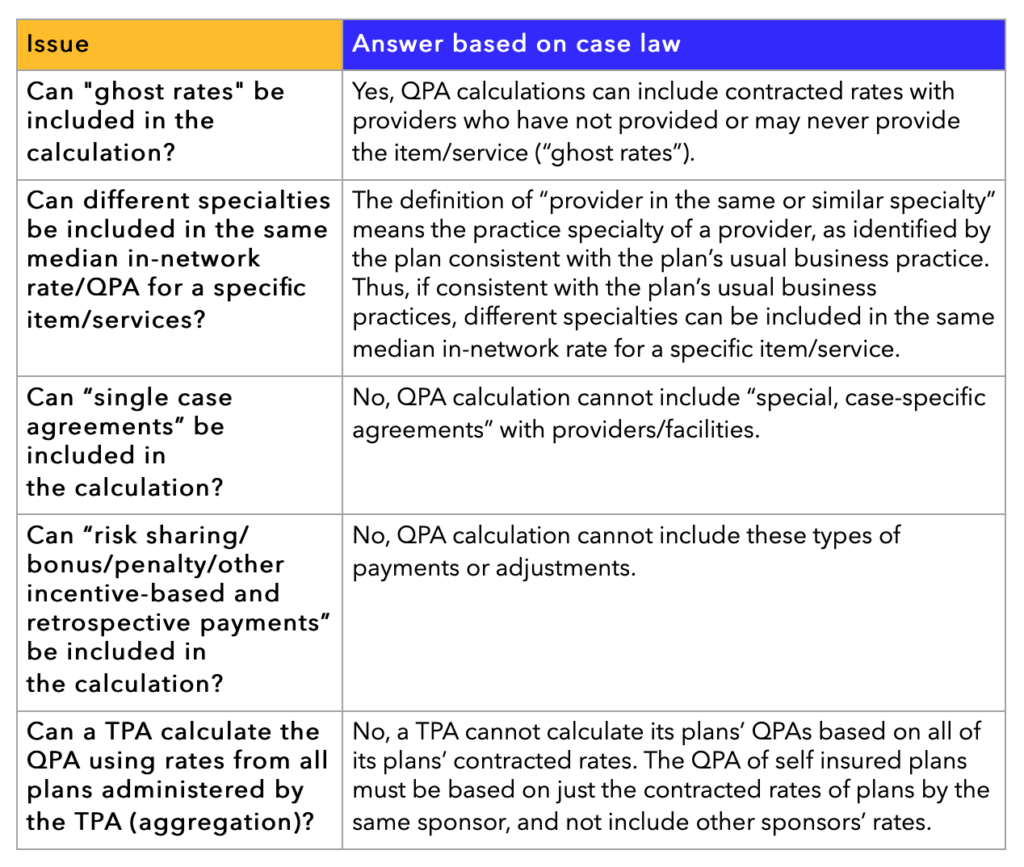

The table below summarizes where we’ve landed in terms of requirements and prohibitions on how a plan calculates its QPA.

Note that TMA III did not address when a health plan uses a “Third Party Eligible Database,” as defined in statute, to calculate its QPAs (when a plan does not have “sufficient information” to calculate its own median in-network rate).

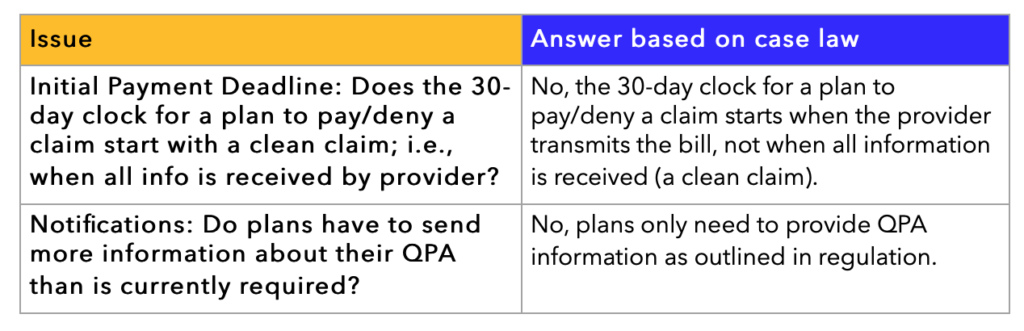

Beyond QPA calculation, the court also decided on the NSA’s process requirements. These are summarized in the table below:

CMS Proposes Updates to NSA Negotiation Process

In my last post, we provided some insight on the proposed changes to the Independent Dispute Resolution (IDR) process and portal in the NSA, including the addition of an IDR registry.

This week, I want to provide insight on how CMS proposes to improve the open negotiation phase of the process, since it’s causing much frustration for all parties.

The rule suggests a lot of changes to open negotiations, with the goal of ensuring all parties have accurate and timely information about the claim and its relevant parties.

The idea is that, if all parties know the “what” and “who” about the claim, then reimbursement disagreements between payers and providers would be more likely settled during the open negotiations phase and fewer parties would be forced to use the IDR phase, which is burdensome and costly for all parties.

Specifically, the rule proposes that open negotiations be managed by all parties through the federal portal. Previously, if a provider disagreed with their initial payment, they would reach out and contact the payer directly to initiate open negotiations, either through phone or email. The payer, then, would continue to correspond with the provider through the same methods.

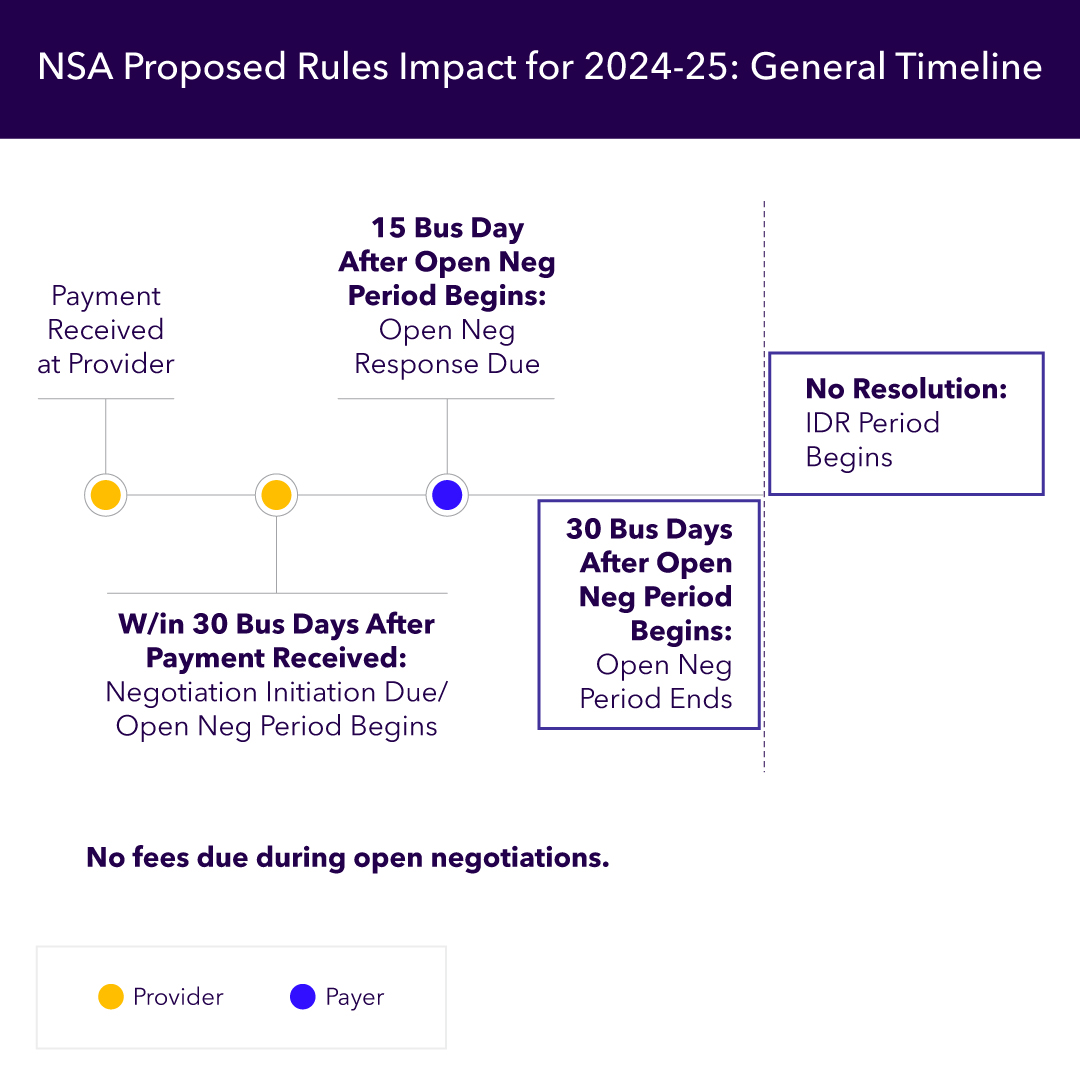

In contrast, according to the proposed rule, the 30-business-day open negotiation period begins on the day the initiating party (usually the provider) submits a notice via the federal portal. Thereafter, all communications between payer and provider are tracked through the portal. No more missing – or misplaced – phone calls or emails.

To initiate the open negotiation period, the rule proposes that providers submit the following information through the portal:

- Contact info to identify the provider, including legal name and NPI

- Contact info to identify the payer, including registration number and plan type (fully or self-insured)

- If provider is being represented by a third party, contact info to identify the third party, including attestation of representation

- Info identifying the item or services, including:

- Date(s) services were furnished, date of initial payment/denial

- Type of service, state where the item/service was furnished, claim number and service code, location where the item/service was furnished

- The initial payment amount and the QPA, if provided with the initial payment/denial and a copy of initial payment/denial

- The member cost share per item/service

- Several attestations and other general information

- An offer of an out-of-network rate

The provider has 30 business days from the receipt of the initial payment/denial to initiate open negotiations by submitting this information to the portal.

The proposed rule continues: Once a provider submits an open negotiation notice, the payer must submit an open negotiation response no later than the 15th business day of the 30-business-day open negotiation period.

As part of the open negotiation response, payers would be required to submit the following information through the portal:

- The same info required by the provider that identifies the provider, the payer (including the payer’s plan type — fully or self-insured — and registration number), and any third party representing either party during the negotiation

- The same information required by the provider that identifies the item/service

- A statement as to whether the payer agrees with the provider’s information regarding the initial payment amount and the QPA

- Statements and supporting documentation as to whether an item/service may be ineligible for the IDR and whether any of the info provided by the provider was inaccurate

- The member cost share per item/service

- A counteroffer to the provider’s offer of an out-of-network rate

A couple things to note here about the proposed changes: First, moving management of the open negotiation period to the federal portal should help expedite the process. Second, however, a lot more information needs to be provided by all parties than is currently required.

While the proposed information requirements may result in a much smoother process, it’s obvious that implementing the requirements of the proposed rule will take some heavy lifting by all parties.

This timeline might help you get a better understanding of the chronology of the NSA’s open negotiation period:

The next big component of the changes in the proposed rule applies to the IDR process itself. Be sure to also read about the new timelines for IDR fees.