Kaitlin Howard is a researcher and writer producing insightful content across the healthcare revenue cycle. She has written and produced content for Zelis, Waystar, and Recondo Technology, as well as agencies. With a B.A. in English and Writing from University of Denver, Kaitlin stays current on market updates on claims management and healthcare payments, publishing a regular educational blog series on industry trends and Zelis offerings.

COVID-19 has amplified the need for a massive innovation effort in all businesses alike. A recent systematic review of COVID has driven significant acceleration to the adoption of digital tools leveraged by providers and patients. In fact, according to William Blair’s Consumer-Centric Healthcare: 2022 Update, virtual health usage among baby boomers increased 155%, rising from only 9% pre-pandemic to 23%

In our recent State of the Provider Network Market webinar, Zelis Senior Product Analyst Jillian Carlile explored 2022’s market insights for Medical, Medicare Advantage, Medicaid, Exchange (HIX), and Dental.

We’ll discuss the highlights below, but you can find the on demand webinar here or read the full report here.

But first, a bit of background.

State of the Market Report: What is it?

Every year, Zelis® aggregates provider network data from hundreds of payers for thousands of provider networks to paint a picture of the provider landscape in the United States.

This year, our 2022 State of the Market report covers five lines of business:

- Medical

- Medicare Advantage

- Medicaid

- Exchange

- Dental

Healthcare in the United States continues to change with trends and regulation; thus, it is important to stay abreast of new developments in managed care.

This year, the key trends of importance are:

- Managed care plan provider growth across all market segments

- Medicare Advantage organization expansion

- Volatility in Exchange network offerings

- Stable Medicaid enrollment and provider participation

- Minimal but consistent Dental provider participation expansion

Additionally, challenges related to thelimited physician supplyin rural areas also has the potential to impact both payers and members.

Forpayers, this means more competition to recruit providers and possible challenges meeting network adequacy or access requirements in those areas. It also means, there is an opportunity for differentiation by utilizing more telehealth benefits to provider network coverage in these areas.

Forrural members, this means it may become increasingly challenging to access care within a reasonable distance and appointment wait time.

This report discusses these trends, leading to actionable improvements for better network outcomes.

Diving into the Data

The focus of the State of the Market webinar was primarily on provider demographic data and provider counts at a national and state level. Jillian dives into network and carrier participation for Medicare Advantage, and Exchange (or Marketplace) business.

The provider stats discussed were pulled from Zelis Network Analytics’ provider database and supplemented with in-depth research from our internal research team.

Our data is directly sourced from carriers’ online directories and represents a snapshot of key market players in the United States. We include providers with at least one managed care contract nationwide, and the underlying data is updated on a quarterly basis. This analysis looks at data from Q2 of 2021.

Medical

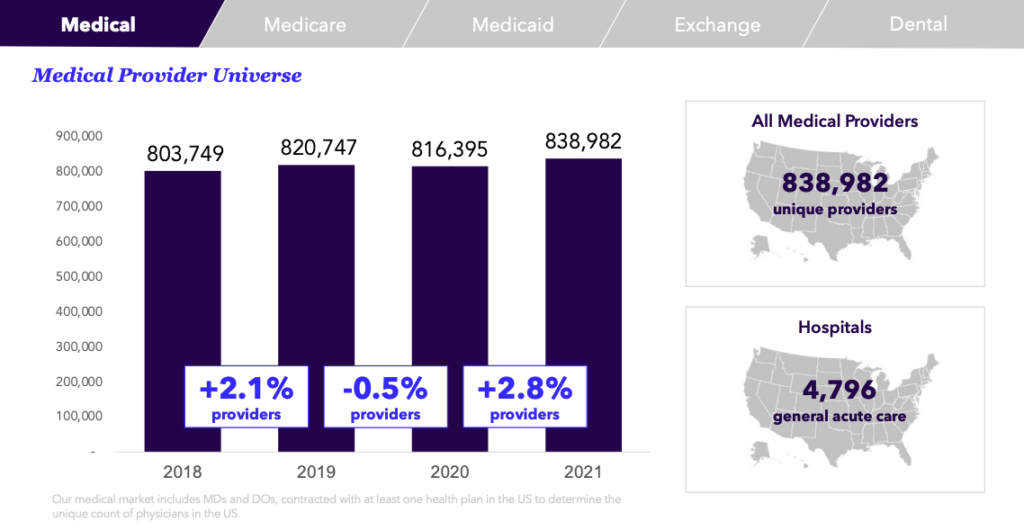

Zelis looks at physicians (meaning: providers with MD or DO degrees, contracted with at least one managed healthcare plan) to determine the unique count of physicians in the US.

As demonstrated in the graph above, in 2021, there were around 839K physicians in the US, which is up 2.8% from the prior year, and almost 5K unique hospitals, an increase of just 1% from 2020.

Other data included:

- 413,124 primary care physicians (PCPs)

- 757,362 MDs

- 504,672 specialist care providers (SCPs)

- 86,534 DOs

Jillian then breaks down physician counts by state, the supply of physicians, primary care providers, and specialists compared to the general population, and number of new providers.

Medicare

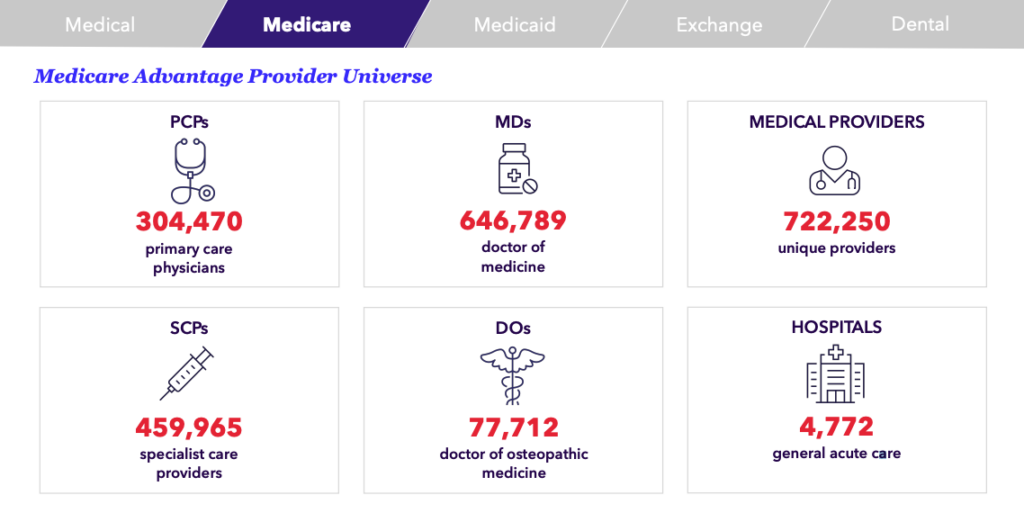

Over the last decade, Medicare Advantage (MA) has grown substantially within the Medicare program, maintaining strong enrollment year after year. In fact, according to the Kaiser Family Foundation, in 2021, more than 26M Medicare beneficiaries enrolled in a Medicare Advantage plan.

So it comes as no surprise that more plans are now participating in this space. Moreover, many Medicare Advantage Organizations (e.g. UnitedHealthcare, Cigna, Healthcare Service Corporation) have expanded their services in states where they were already doing business.

This year, our Sate of the Market analysis found that growth in brand new Managed Medicare organizations was minimal. A “brand new plan” is typically described as a plan that has historically offered commercial coverage that is now expanding into MA. While truly “brand new” plans are rare, many Managed Medicare organizations did expand their service areas in states they were already doing business, offering plans in more counties than ever.

But what does this mean?

More competition. And a newfound need to invest in and implement a competitive strategy.

Medicaid

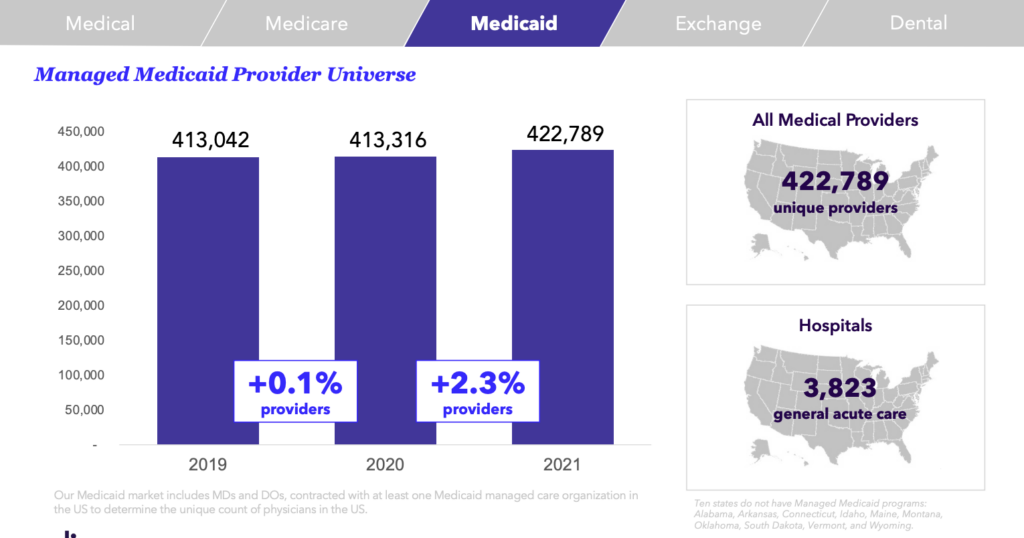

Enrollment in Managed Medicaid plans has plateaued at around 54K enrollees over the last several years, but nearly 7 in 10 Medicaid beneficiaries are enrolled in a Managed Medicaid plan.

There are currently around 423K positions in the US contracted with a Managed Medicaid organization, which is up 2.3% from 2020. But there’s been a drop of almost 5% when you take a look at the number of general acute care facilities.

According to our analysis, total unique providers were sitting around 422K, with almost 4K general acute care hospitals, 213K specialist care providers, and 224K primary care physicians.

Exchange

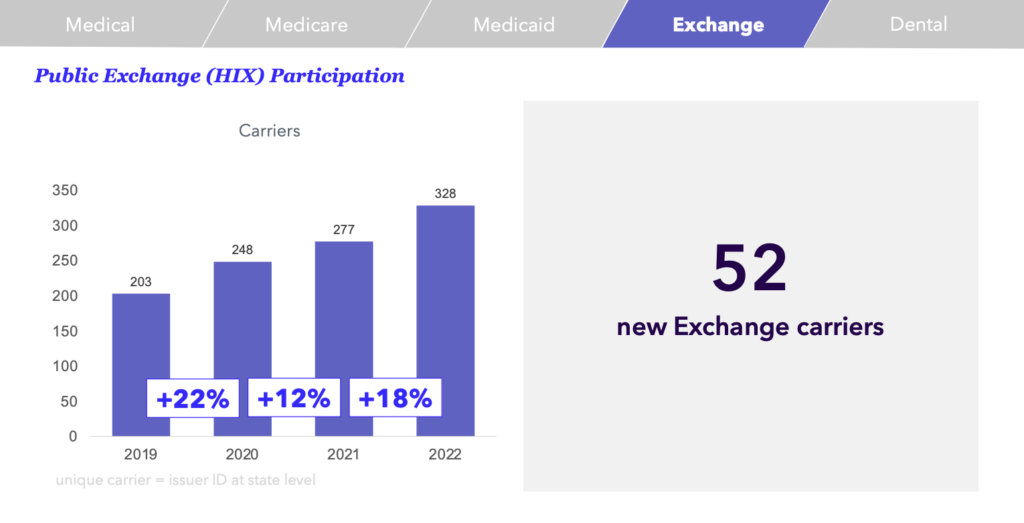

Enrollment in Exchange plans started out strongly with 8M enrollees, but that doesn’t mean there haven’t been any bumps along the way.

Luckily, in 2021, we began to see an increase in enrollment once again with a growth of over 5% from the previous year. And enrollment for 2022 is looking even stronger, reaching 14.5M enrollees.

Moreover, there has been a substantial increase in interest from carriers over the last few years. Many plans are now expanding their participation in the Exchanges. In fact, in the 2022 plan year, we found 52 new Exchange carriers.

The number of networks offered is also increasing dramatically with 125 new Exchange networks currently offered by carriers. That’s a growth of almost 25% from the previous year.

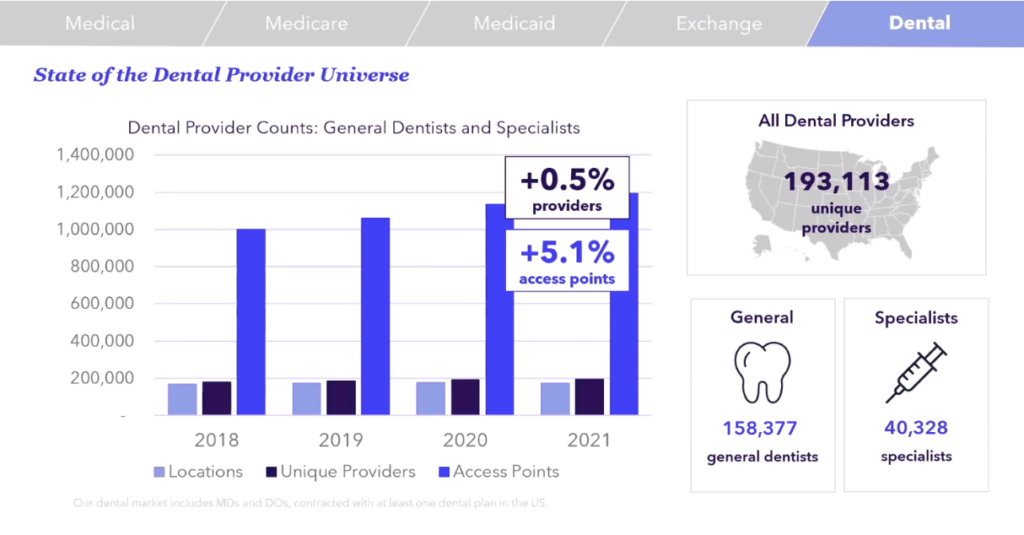

Dental

Put simply, there are a lot of Dental providers in the US.

After tracking the number of providers, addresses and locations, and access points over the years, we were able to determine the number of dental providers from 2018 to 2021. In almost 50 networks, there are currently around 174K unique dental locations in the US. This represents an increase of around 4% from 2018.

When taking a look at general dentists, it seems there is about one for every 2K people, but specialists fall around 1 per 8K people in the general population.

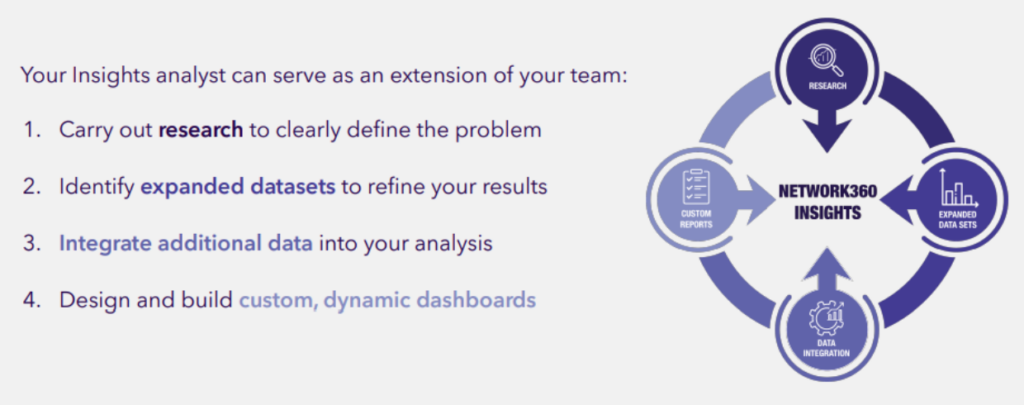

Tell your network story

Whether you are developing, managing, or selling networks; Zelis can help you tell your network story with Network360® Insights

We remove the noise, so you get insights faster.

The Wrap Up

We covered quite a bit of information during the webinar, much of which we weren’t able to fully dive into in this blog.

If you’re interested in finding out more about specific data points, you can access the full report at any time.

And once again, if you’d like to listen and watch, here is the webinar.